The Major Gift Challenge has taught you how to plan.

Planned Giving is future-oriented, and designed to benefit the donor and your cause. It’s not your plan, it’s your donor’s plan, and it’s an important part of your Major Gift program.

If you’re unfamiliar with the Challenge, you can learn more about it here.

Planned Giving can seem confusing. But take a closer look you’ll see it’s not complicated if you have a plan.

Frequently, planned gifts are the largest gifts a donor gives, so it’s an especially important part of your major gift program.

What is Planned Giving?

Planned Giving isn’t just a category it’s a description. Planned Giving helps donors express their desire to see your cause flourish, and to get the best tax advantages for their giving.

Planned Giving includes kinds of gifts that have special tax benefits. Examples of planned gifts include assets such as stock, life insurance, and real estate. Other types of planned giving vehicles include annuities and trusts.

The most common type of planned gift is a bequest — in other words, leaving money to a charity in your will.

If you do nothing else, your organization can certainly accept bequests, because they take little technical knowledge or professional help on your end.

4 Steps to Secure Planned Gifts

Here are three simple steps to get you on the road to raising planned gifts.

1. Establish your acceptance policies.

Decide what you will and won’t accept.

I know, you’re a fundraiser, not a fundrefuser. Not accepting gifts is hard, but there are probably planned gifts you shouldn’t accept when just getting started. Some examples are gifts of real estate and works of art.

Real estate can be complicated, and unless you know what you’re doing, it can cost you more than it’s worth.

Let’s say donor John Doe wants to give you a piece of land. You’re excited, because it seems like such a generous gift. You accept the land and then go about trying to sell it. Unfortunately, it turns out the land John Doe gave you is a toxic waste dump. Your organization is now stuck with bills — including clean up expenses, before trying to sell.

Then there’s the donor who gives an organization a piece of swampland which is unsalable. The donor gets a tax write-off while you get a headache, which can cost you money.

Work of art gifts can be similarly complicated because art is expensive to store, insure, transport, and sell.

Plan ahead. Have policies in place about what you will and won’t accept.

When a donor comes to you with a planned gift that is beyond your current ability to process, you can point to your policies. Another good approach is to ask donors to sell these assets first and donate the proceeds to your organization. Some will and others won’t. Either way, your organization won’t be stuck footing the bill.

A simple policy states that each potential gift is discussed by the planned giving committee before accepting a gift. This way, there’s not cut and dry rules about what you will and won’t accept, but you can discuss it on a case by case basis.

2. Manage different types of planned gifts.

There are many types of gifts which might take “planning” — primarily planning for tax benefits. Often the gifts come to the organization in the future, but not always.

Planned gifts include:

- Current gifts are generally assets, including stock, real estate, and art.

- Deferred gifts that can provide income to the donors such as charitable gift annuities and trusts. Gifts of life insurance would also fall into the category of deferred gifts.

- Bequests, when money is left to an organization through a will.

For some of the aforementioned gifts, you will need professional, technical assistance for things like setting up charitable lead or remainder trusts, and charitable gift annuities.

Gifts that are generally easy to accept include bequests, gifts of stock and life insurance.

3. Market planned gifts (in other words, raise them).

Start simple — begin by accepting bequests. Have an attorney provide you with the necessary language (2-3 sentences) people could add to their will.

You can start marketing your Planned Giving program simply by letting your supporters and donors know you accept bequests. Do this by providing language on your website and in your newsletter. You’ll also want to have the discussion with your board members and biggest donors.

Death is a difficult topic and many people (including fundraisers and donors) are uncomfortable discussing it. Approach it in terms of leaving a legacy. Ask your donor, “How would you like to be remembered?”

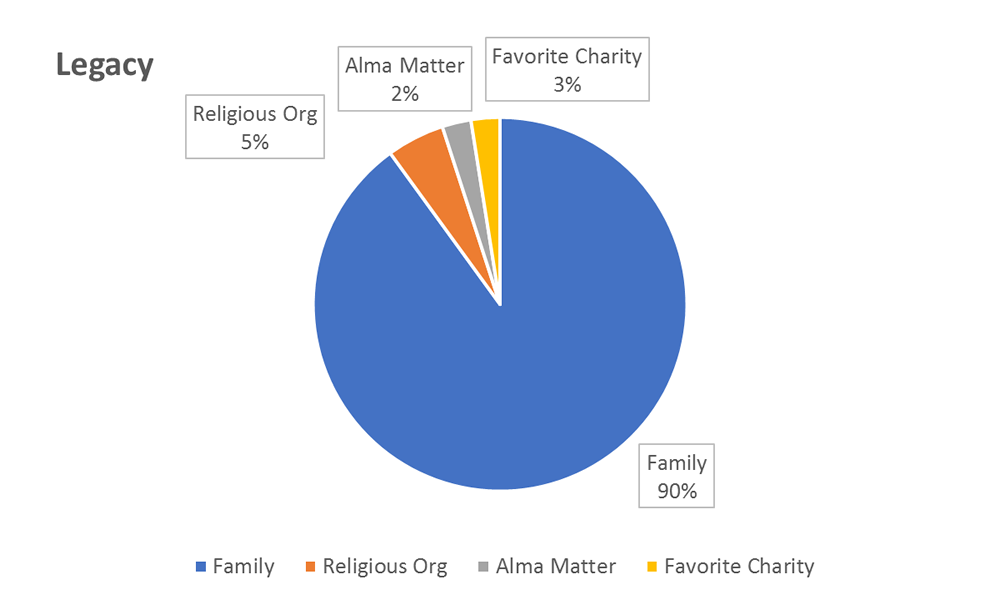

When broaching the topic, many people will tell you they want to leave their money to kids and grandkids. Family always comes first, so I like to have donors see their life as a pie. Ask them to think about what has been important during their lifetime.

They might leave 90 percent to family, and still provide for their religious organization, alma matter, and favorite charity. None are mutually exclusive.

4. Partner with necessary professionals.

Finally, you should partner with professionals, including attorneys and financial planners, for the occasions when you need technical help.

However, donors should use their own professional advisors. As an organization, you never want to provide legal or financial advice.

Keep in mind, planned gifts often take many years to come to fruition. If someone in your position had been soliciting bequests 20 years ago, you would be reaping the rewards of their work now. That’s why it’s important to start thinking about this today.

We often joke, once someone leaves you a bequest, they generally add 10 years to their life … a real incentive for donors to leave bequests!

Challenge Yourself Action Item

Step 1: Create a planned giving committee.

Create a Planned Giving committee to develop a Planned Giving program. Include board and non-board members who understand the importance and advantages for your cause and your donors.

Step 2: Establish your acceptance policies.

Create a policy to determine which gifts you will and won’t accept. Go ahead and download the sample acceptance policies below this post.

Step 3: Begin marketing your planned gift program.

Create a plan to market your Planned Giving program … and get to work!

Going Further with Major Gifts

You’ll find more details on planned giving in my 7-week online course, Mastering Major Gifts. There you’ll discover how to solicit planned gifts, and you’ll also learn step-by-step precisely how to get your Planned Giving program up and running.

Act, Comment and Participate

Now it’s your turn to share. Have you ever raised a planned gift before? If so, how did it come about and what impact did it have on your organization?

Let me know in the comments.

I stumbled on your site– you have several great resources/information on planned-giving, (of which several of my prior N/P) organizations did not strategically explore and create a collaborative relationship.

TMI Consulting Group