For many years the nonprofit sector has been battling the “overhead myth”.

The overhead myth is the idea that overhead costs (administrative and fundraising) are bad. But the truth is, every organization in both the corporate and philanthropic sectors require overhead (or operating) costs, and they could not function without them.

Overhead costs are comprised of expenses related to administrative and corporate costs, including:

- executive director and CEO’s salaries

- fundraising-related costs

- research and development

Note, however, that when money is spent on research and development in the corporate sector, it’s called an investment rather than an expense.

Nonprofits need to learn from their corporate counterparts and start investing in the organization and its staff members.

Who Perpetuates the Overhead Myth?

Sadly, the overhead myth is not only perpetuated by the media and donors, but by nonprofit professionals and board members too.

I’ve been at more than one board meeting where board members and staff members take pride in their low overhead costs. Not to mention nonprofit leaders bragging about zero percent of donor contributions going to fundraising costs. What a fabrication!

As leaders in the nonprofit sector, we need to realize that high fundraising costs are often an investment in future fundraising, and therefore impacts the ability of the organization to expand and grow. By not investing in fundraising, nonprofit leaders are deciding to stunt growth potential of the organization.

Prioritizing Impact vs. Overhead

I often wonder why donors prioritize overhead over impact. For example, why is an organization with lower overhead automatically “better” in the donor’s eyes?

If organization “A” has 10% overhead, but doesn’t regularly evaluate its programs and services, it has no basis on which to claim success towards its mission. In fact, the staff there doesn’t really know if they are making any progress at all.

On the other hand, if organization “B” has 45% overhead, but regularly evaluates its programs and adjusts programs and services as appropriate and necessary, they can say for sure exactly what impact they are having.

Which would you rather give to — organization “A” or “B”?

Moving Your Nonprofit in the Right Direction

Although we have been having the overhead myth conversation for many decades, there hasn’t been much progress in terms of the shape of the conversation, until now…

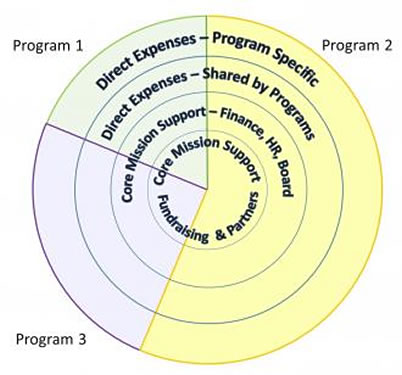

Recently, Curtis Klotz of the Nonprofits Assistance Fund developed a brilliant new way to talk about overhead in his post, Balancing the Mission Checkbook.

Overhead as a critical component of each program

Instead of thinking about overhead as separate percentage of an organization’s budget, the Nonprofits Assistance Fund has created a diagram to help donors and supporters think about overhead costs as a critical component of each program.

This new visual clearly helps donors and community members understand the central function of overhead and administrative costs, which are in the center of the diagram. No programs or services could operate without these fundamental expenses.

The Solution to the Overhead Myth

We must continue the overhead conversation. It’s up to us to help our board and staff members, donors, and community members understand the crucial role overhead expenses play in our ability to do good work. And, remember to make the important distinction between overhead and impact.

What are your thoughts on this topic? Leave your comment below and join the discussion.

Great article. At our adaptive riding and equine assisted therapy center, our fixed costs are very high – horses are expensive! Even our smallest programs require enormous overhead to operate and this has been a source of concern. Your article is definitely food for thought about shifting the focus of conversations with funders.

Trish – Horses are expensive, but they are certainly not overhead. I would put them and all related expenses into program expenses. Overhead expenses should only include things such as administrative office rent (not stables or pasture – those are program expenses) and executive salaries. Get a good accountant to help you figure this out!

Excellent way to look at expenses in a more productive way!

Yesterday, I was having a discussion with a colleague (another Executive Director) about the impact of our (nonprofit) sector on the community we serve: Beyond providing direct service to vulnerable populations, we collectively employ a very large workforce which contributes greatly to the local economy, and much of the recent redevelopment of vacant/neglected buildings in our region is due to the efforts and vision of nonprofits and are serving to breathe life back into long-neglected properties and communities.

Who would expect any organization/group to make such significant contributions without making an investment in their own capacity and infrastructure? I think we should work harder position our work within the larger context of our overall contribution beyond delivery of program services when positioning our “overhead” as the investment it truly is.

In my organization I’m now distributing ALL expenses among programs. Because in reality, every single thing we do supports programs. It’s just a question of carefully assessing what percentage of overhead and staff time support which program. Similarly, all income is distributed among the programs. What do you think about completely abandoning any reporting of overhead? Do you think donors will feel that something is missing? Do you think that we will be missing something ourselves? Thank you for your article, it’s something that has been concerning me for years.

Hi Teta – Thanks for your response. I hope you are using a good accountant to help with your reporting. I hate to see you swing too far in either direction. Of course there are administrative costs of running a nonprofit. We need to report them accurately and help donors understand their value.

Agree, this is an excellent way to think about and present expenses more holistically. As stated in the article, research is a key investment. I’m wondering where it falls in the diagram and suggest it needs its own place.

Love the graphic and will add it to our “toolbox”, however I don’t think its use will keep funders from asking, “What % overhead do you have?”

The best and most accurate thing we can do when looking at an area typically considered to be overhead, to be sure to attribute the portion of that expense to various programs as well as G&A. If we are doing fundraising only for a specific program, then it is a program expense. When Finance doubles in busy season as program registration, the portion of their time that goes to that is a program expense. As a small staff, I spend the lion’s share of my time planning & directing programming, and that portion is attributed to program expenses.

Certain things, like Board expenses, are purely G&A, however I would argue that R&D, if program specific, is not overhead, but a program expense.